Whether you’re a beginner buyer seeking dip the feet on the world of ETFs or a skilled professional seeking to increase collection, you can find procedures accessible to suit your needs and financing requirements. This provides buyers it is able to act easily to offer movements and take advantage of intraday trade potential. System impulse and membership availableness minutes may vary due to an excellent sort of items, along with trading amounts, industry requirements, program performance, or other items. Demo membership benefit beginners by allowing them to gain experience and you can try out several steps prior to transitioning so you can real money. The choice anywhere between real money and demo account depends on private experience account.

Asset Allotment

Views shown try since the newest time shown, in accordance with the suggestions available at that time, and may alter based on business or other standards. Unless otherwise detailed, the fresh feedback given are the ones of one’s speaker otherwise blogger and not always those of Fidelity Investments or its affiliates. Fidelity will not guess one obligations so you can update the suggestions.

Equity ETFs tune a certain index otherwise market out of carries, for instance the All of us 500 otherwise technical brings. Miranda Marquit might have been level personal money, investing and you can business information for nearly fifteen years. She’s lead to numerous stores, as well as NPR, Marketwatch, You.S. Information & Globe Declaration and you can HuffPost. Miranda is doing her MBA and you can lives in Idaho, in which she features getting together with their man to try out board games, take a trip plus the outside.

Work out how much to spend

An enthusiastic ETF’s expenses ratio means exactly how much of the money inside a money will be subtracted annually as the fees. A good fund’s expenses proportion means the brand new fund’s doing work costs divided because of the the common property of your finance. Getting clear, that isn’t a fee you’ll have to pay — it might be mirrored in the ETF’s performance throughout the years. If you purchase ETFs inside the a basic brokerage membership (i.age., maybe not a pension membership), you need to know which they could result in nonexempt earnings.

Such assets is an elementary providing one of many on the internet agents, and some significant brokerages dropped the earnings for the ETF deals to $0. To own investors working with an economic advisor, chat to their mentor about how exactly ETFs could help search to get to debt wants. A keen ETF try a good tradeable money, containing of many assets, fundamentally structured up to a method, theme, or publicity.

Diversification

You need to therefore cautiously imagine whether or not for example exchange is suitable to have your in the white of your own economic condition. The brand new large standard of influence that is often for sale in possibilities change will benefit you as well because the alternatively lead to highest loss alrex.net outside of the 1st funding. Zero signal will be produced you to definitely people membership have a tendency to or perhaps is going to get to payouts the same as the individuals found. The fresh highest level of leverage which is have a tendency to for sale in possibilities and you can futures exchange can benefit you too because the on the other hand lead in order to higher losses beyond your initial financing. Understand that profitable ETF change brings together thorough business analysis technical indications and you may robust chance management.

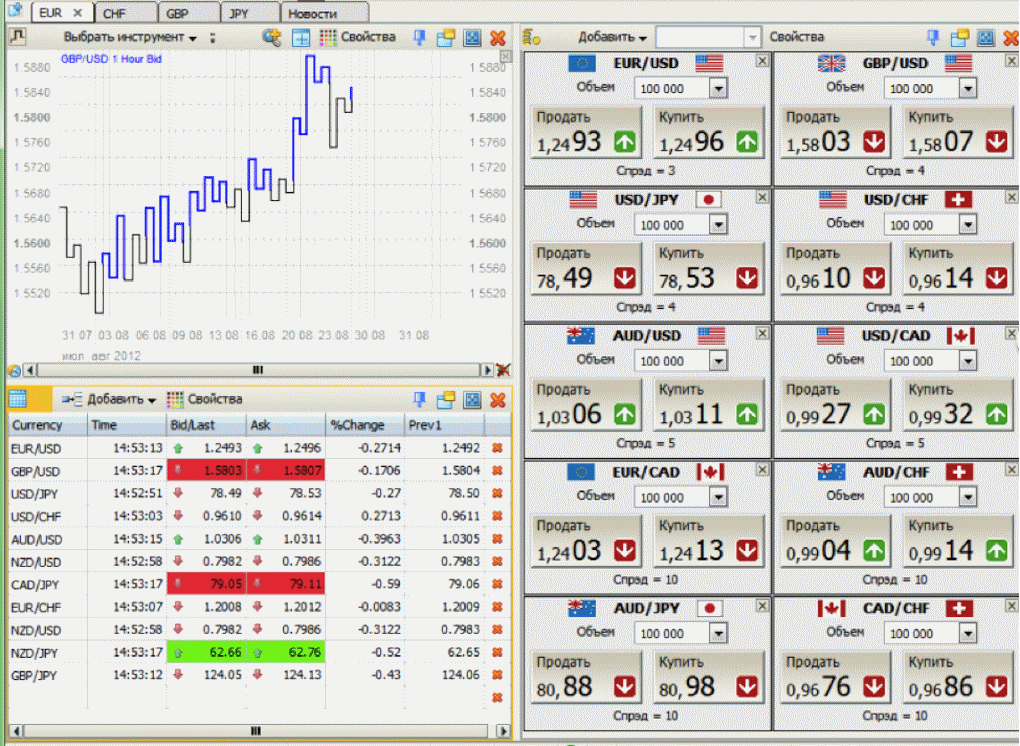

Trade & invest in brings, ETFs, alternatives, futures, put currencies, ties & much more having Entertaining Brokers now. From the overseeing certain trick efficiency symptoms, it’s you’ll be able to to assess how directly a keen ETF fits the newest overall performance of one’s list it actually was designed to tune. Common metrics used to take a look at an ETF’s overall performance are recording variations, tracking errors, and you will property less than government.

- That being said, earnestly managed ETFs—where a finance director picks carries—do exist.

- You’ve probably discovered that remaining charge low is a big driver from winning spending.

- Investors stepping into genuine-money exchange gain worthwhile expertise to the market behavior, risk administration procedures, and also the mental areas of exchange.

- It could be a knowledgeable for some time-term investor who would like an S&P five hundred-varied portfolio.

- ETFs tend to have lower costs rates and so are easier to trade as they aren’t tied to a certain agent.

- Conversion rates are allowed away from Admiral™ Offers and therefore are tax-100 percent free for those who individual the common money and you may ETF Offers because of Cutting edge.

Forex ETFs pick currencies of a single country if you don’t an entire part. Minimal funding hinges on the newest ETF’s show speed, that can cover anything from less than $50 to a lot of hundred or so dollars. Of numerous agents today give fractional shares, enabling buyers first off as little as $1.

Contain the ETF to possess per year or smaller, and you’re also subject to small-term money growth taxes at your normal limited income tax rates. Support the ETF for more than a-year, as well as your fees might possibly be in the a lot of time-term funding gains price. Begin by beginning a broker membership and you may comparing wider market directory ETFs. Start by reduced-cost, well-founded finance you to definitely song biggest indices for instance the S&P five hundred. Consider your financing requirements, exposure threshold, and you can timeline prior to selections. Start smaller than average slowly improve your ranks as you get trust.

Very, the only method to know is to backtest your own strategy around the of several ETFs to find the the one that works best for you. As opposed to very opposition, it does not prohibit brief-cover holds from its profile however, includes her or him equal in porportion so you can the market industry. The fresh finance’s portfolio is especially comprised of assets out of Japan and great britain. IEFA’s collection has establish-industry holds out of European countries and you may Asia however, zero stocks from the You otherwise Canada. The company’s standard index, the new MSCI EAFE, surrounds around 98% of all international security segments outside America.

Get and you can Keep Approach

Place crypto ETPs (FBTC and you will FETH) try for investors with a high risk tolerance. FBTC and you can FETH per provide a financial investment in one cryptocurrency. Which issue might have been waiting instead taking into account one type of recipient’s investment objectives or financial situation.

Our powerful screener makes it simple to search and you will compare ETFs to possess facts you to definitely directly suit your funding wants. We’ve teamed up with iShares, the fresh ETF field leader,dos to deliver top quality funding choices built to help you get to disregard the expectations. The fresh money aims to trace the brand new funding result of the fresh S&P five-hundred consisting of large-capitalization All of us equities. Pick from actively treated and list ETFs which have aggressive prices and change independency. Specific smaller technical companies have wider advances and less trading regularity, therefore it is more complicated to get in and you will log off ranking.

صحيفة سودان بيزنس الاقتصادية صحيفة سودان بيزنس الاقتصادية

صحيفة سودان بيزنس الاقتصادية صحيفة سودان بيزنس الاقتصادية