Clearing up an estate can be a long and tough procedure packed with various twists and turns as conflicts occur over how the estate must be distributed. Nonetheless, this procedure is a lot more likely to be a long and tough one when the estate itself is fairly huge; the bigger the estate, the bigger the possibility of disagreements ends up being and the more components there are to be sorted via.

But a number of us do not wind up getting a large estate throughout our life times. For a lot of us, we’re just going to get a little estate. This is where little estate testimonies come into place, as a means of quickening the procedure of shutting an estate. Listed below, we’ll have a look at exactly what specifies a small estate sworn statement, what the benefits of a little estate sworn statement are, and how you go about submitting a tiny estate sworn statement.

What is a Little Estate Affidavit?

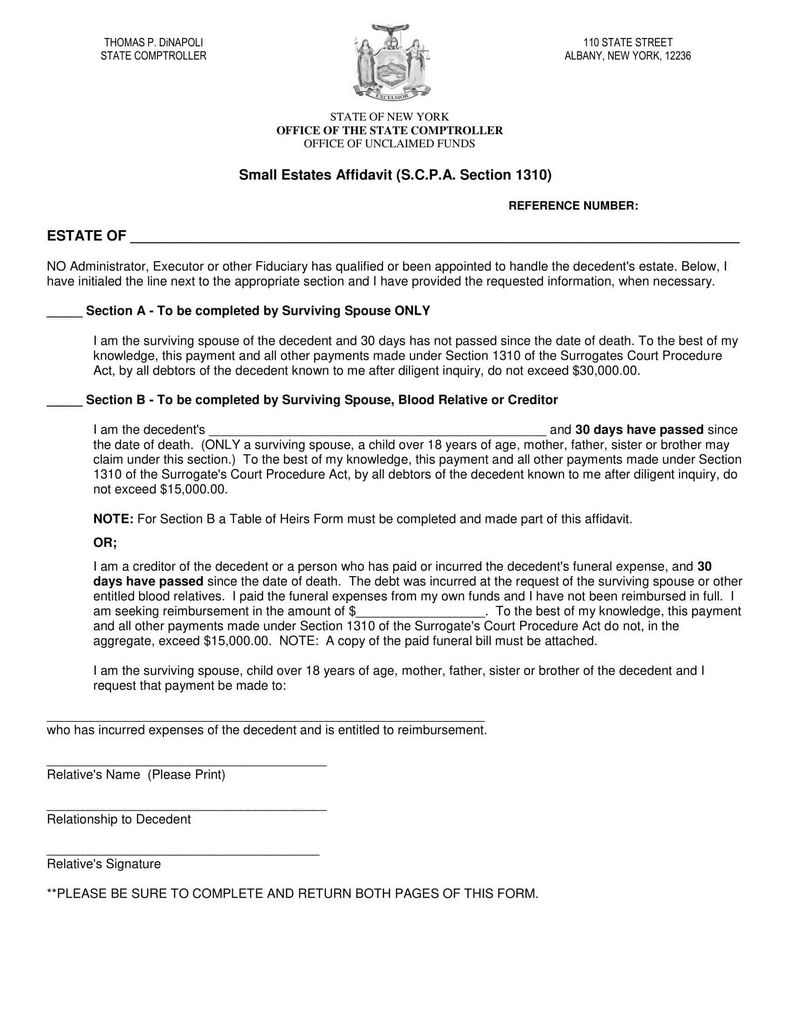

A small estate testimony is a sort of legal paper that is utilized to accredit the transfer of building and/or assets from a will to the people they are meant for without having to go through the probate procedure.Hawaii Affidavit of Small Estate https://affidavit-form.com/hawaii-small-estate-affidavit-pdf-form/ The probate process can be an extremely lengthy process, in addition to a possibly pricey one, and so little estate testimonies were created in order to lower the quantity of time and sources it considers a beneficiary to get their inheritance.

Normally talking, the little estate affidavit process begins with the filling out of kinds that need the individual completing them to offer summaries (consisting of the value) of building and possessions that are to be moved, info concerning the deceased individual, a listing of those parties thinking about the estate, along with other information that can transform from one state to another depending on the particular legislations present.

, the value of the estate must be below $50,000 in order to get approved for a little estate testimony.

When Can You Utilize a Little Estate Affidavit?

In order to receive a tiny estate sworn statement, the estate has to deserve below $50,000. In some states, this number can go as high as $150,000, but not here. The first step to figuring out if a small estate testimony can be utilized is to go about valuing the building and assets of the estate to establish their total amount. It is also essential to find out if the deceased had a last will and testament., you need to wait 45 days before filing a tiny estate affidavit.

While a little estate testimony can be utilized in these circumstances, there are likewise circumstances in which a small estate affidavit will certainly not be feasible. Certainly, what comes to mind first is situations where the estate is valued at more than $50,000. However also in cases where the estate’s value does can be found in below this limit, other aspects might stop a small estate affidavit from functioning. If probate proceedings have already started after that you may not utilize a small estate testimony.

Just how Do You Submit a Tiny Estate Affidavit?

To file a little estate testimony, you must initially await 45 days after the decedent’s death. You rate to submit the documents and try to get it started prior to that but you’ll discover that no court of probate clerk will certainly accept a tiny estate testimony up until after 45 days have actually passed so it’s much better to just wait.

Next off, make certain that there are no consultations or petitions outstanding for the role of the individual representative of the estate. You can find out if there are any type of by doing a search through the Tennessee Judiciaries Public Medical History.

The next action is to complete the paperwork needed. You will require to have a copy of the decedent’s will, which you can obtain from the County and Local Records Archives. You will additionally need to fill in a tiny estate sworn statement, which we’ll go over in size in one moment.

Finally, when all that is total, you have to submit your paperwork with whichever court of probate was considered local to the decedent’s final long-term residence. After that, similar to many points, it ends up being time to wait to find out just how it went.

Let’s have a look at the details you’ll be required to fill in for a tiny estate affidavit:

- The name of the area of the circuit court

- Docket number

- Estate name

- Tennessee affiant name

- Tennessee decedent age

- Decedent date and place of fatality

- Residential address of decedent

- Whether a will was left

- Call of decedent’s financial institutions

- Address of lenders

- The amount owed to creditors

- Every asset of the decedent’s

- The place of assets

- The worth of the property

- The checking account numbers for the decedent’s accounts

- Call of the next of kin

- Addresses of the next of kin

- The relationship of the near relative to the decedent

- Age of the next of kin

- The day of when you authorized the sworn statement

- Your address

- Notarization of the trademark

There is a great deal of details that needs to be collected in order to submit a tiny estate affidavit. Given that you have 45 days from the date of the death to be able to file the affidavit, this home window of time can be utilized to pursue any one of the called for info that you don’t presently have.

I Still Do Not Comprehend Small Estate Affidavit, What Should I Do?

Estate regulation can be a confusing thing for people to cover their heads around, we definitely get it. We below at Crow Estate Preparation and Probate have made it our business to understand the full scope of estate legislation and so we understand specifically just how complicated it can get.

If you are having problems understanding tiny estate sworn statements or whether it’s the best thing to do with the certain circumstances you’re dealing with, then connect to Crow Estate Planning and Probate. We’re always happy to help people like you determine the most effective strategy when it concerns clearing up an estate complying with the death of a friend or member of the family.

صحيفة سودان بيزنس الاقتصادية صحيفة سودان بيزنس الاقتصادية

صحيفة سودان بيزنس الاقتصادية صحيفة سودان بيزنس الاقتصادية